Travel Insurance Taiwan 》選擇國泰旅遊平安險的五個原因 (非業配)

Last Updated on 2024-02-23 by Foodelicious

國外旅遊保險推薦哪一家 ? 我選擇 線上投保 國泰旅遊平安險加不便險. 在文章的前言部分也會提到為何不保兆豐郵輪保險, 文章裡也有英文保單 Sample.

Which travel insurance is recommended if based in Taiwan ? I chose to purchase Cathay Travel Insurance along with Inconvenience Insurance. In the preface, I will also mention why I did not choose Chung Kuo Cruise Insurance. There are also English version travel insurance sample.

首頁圖片來自: CANVA

📧 自媒體採訪, 文字邀約, 行銷合作, 請 Email 至 [email protected]

If interested in cooperation, please Email to [email protected]

♛ 目錄標註: 只需要按下自己想找的項目, 會直接到所選擇的項目

♛ Table of Content Remark: Just click the subject that you want to look for. It will bring you to the subject right away.

目錄 / Table of Contents

前言 Preface – Must Read

我沒想到 2024 年第一篇 Travel / Lifestyle 文章會是關於旅遊平安險與不便險.此篇文章純粹紀錄. 這次出國情況比較特殊, 我是要坐飛機去香港坐郵輪, 會到香港, 上海, 韓國釜山與日本, 再從日本東京機場坐飛機回到台灣. 總共 15 天.

沒有選擇郵輪險的原因

✅ 兆豐保險是台灣唯一一家有郵輪險 , 無法比較價格

✅ 兆豐保險的郵輪保險必須是台灣港口上船. 我是在香港港口上船, 無法申請兆豐郵輪險

✅ 郵輪險可以直接上網找國外郵輪公司保, 只是理賠程序太麻煩

老實說, 保險客服也不清楚如果是在公海行駛出意外 , 台灣的旅遊平安險理不理賠. 我的 Travel Schedule只有三天是一整天待在郵輪上. 最終還是選擇在台灣保 “旅遊平安險加不便險”.

I didn’t expect that the first Travel/Lifestyle article of 2024 would be about travel insurance and inconvenience insurance. This article is purely for documentation. The travel situation this time is quite unique. I will be flying to Hong Kong to take the cruise. I will visit Hong Kong, Shanghai, Busan in Korea, and Japan, then flying back to Taiwan from Tokyo Airport . A total of 15 days.

Reasons for NOT choosing cruise insurance:

✅ Chung Kuo Cruise Insurance is the only company in Taiwan that offers cruise insurance, making it impossible to compare prices.

✅ Chung Kuo Cruise Insurance requires boarding at Taiwanese port. I will be boarding in Hong Kong and cannot apply for Chung Kuo Cruise Insurance.

✅ Cruise insurance can be directly obtained from foreign cruise companies online, but the claims process is too complicated.

To be honest, even the insurance customer service is not clear about whether Taiwan’s travel insurance will cover accidents that occur in international waters. My travel schedule only involves three days spent entirely on the cruise. In the end, I chose to purchase “travel insurance plus inconvenience insurance” in Taiwan.

選擇國泰旅遊平安險的原因

Reasons to Choose Cathay Century Insurance

經過 Google Search 與各平台討論 , 許多台灣人都是選擇在國泰或是富邦購買旅遊平安險與旅遊不便險. 我選擇國泰有以下幾個原因.

After conducting a Google Search and reviewing discussions on various platforms, many Taiwanese people choose to purchase travel insurance and travel inconvenience insurance from Cathay or Fubon. I chose Cathay for the following reasons.

旅遊保險相關資訊皆在同一個網頁

All Travel Insurance related info are at the same web page

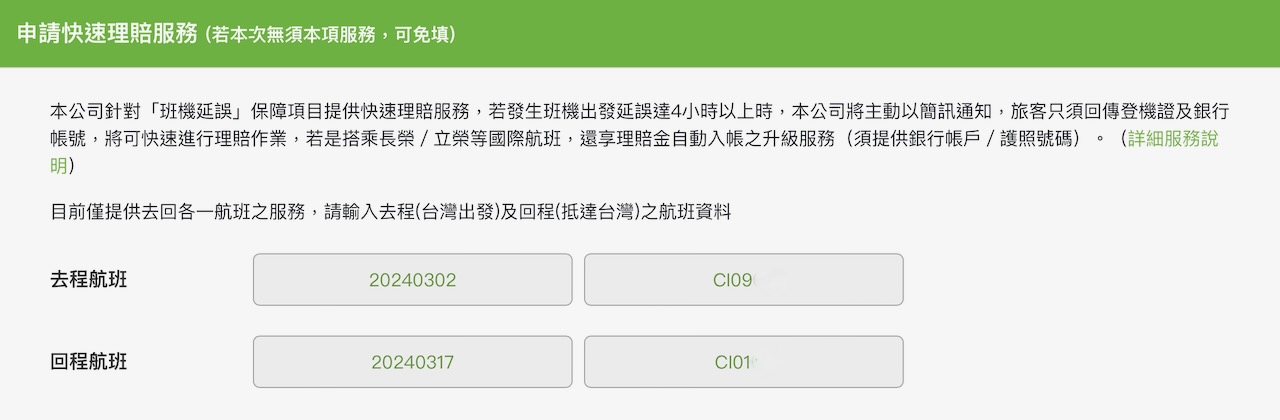

國泰產險網頁 (Link) 將 快速理賠說明, 急救求助介紹,海外旅行綜合保險保障範圍與金額比較 , 海外服務電話, 與網路電話連結放在同一個網頁. 旅客能在最短時間找到聯絡與解決方式.

✅ 項目細節很多:

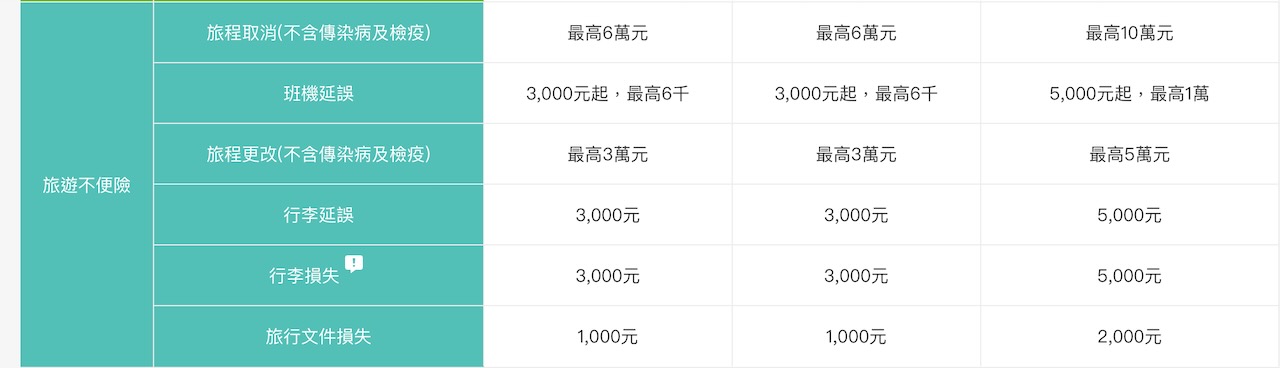

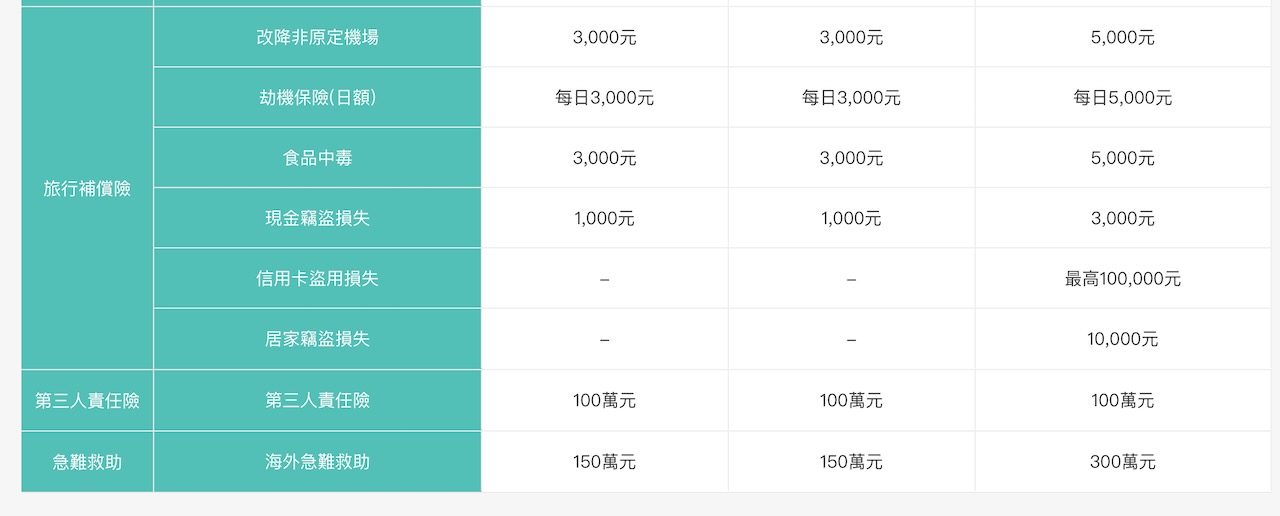

國泰旅遊保險項目有我意想不到的項目 – 劫機保險費用, 食品中毒費用, 現金竊盜損失費用.

Cathay Insurance’s website (Link) combines information on fast claims processing, emergency assistance, a comparison of coverage and amounts for comprehensive overseas travel insurance, overseas service phone numbers, and online phone links on a single page. Travelers can quickly find contact and resolution methods.

✅ Detailed items:

Cathay Travel Insurance includes unexpected items such as hijacking insurance expenses, food poisoning expenses, and cash theft loss expenses.

Link: https://www.cathay-ins.com.tw/cathayins/personal/travel/oversea/

提供準確的線上保險試算

Offer accurate insurance calculation

富邦與國泰皆有線上保險試算. 國泰試算投保 ( Link) 也可以用手機操作計算. 試算的結果就是最後的金額, 不會有額外的金額. 直接網路刷卡即可

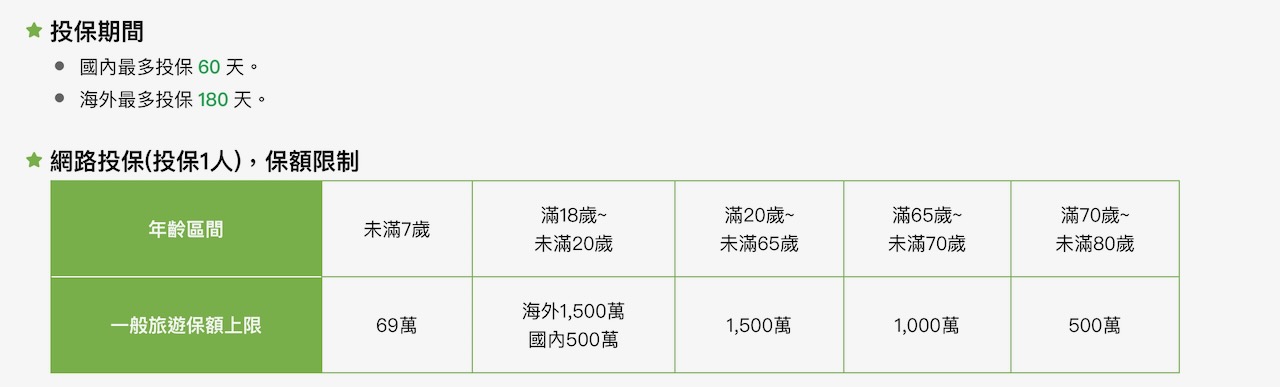

需注意事項

✅ “旅遊期間”是 出門開始旅行的時間 為主 , 而不是飛機班級起飛的時間

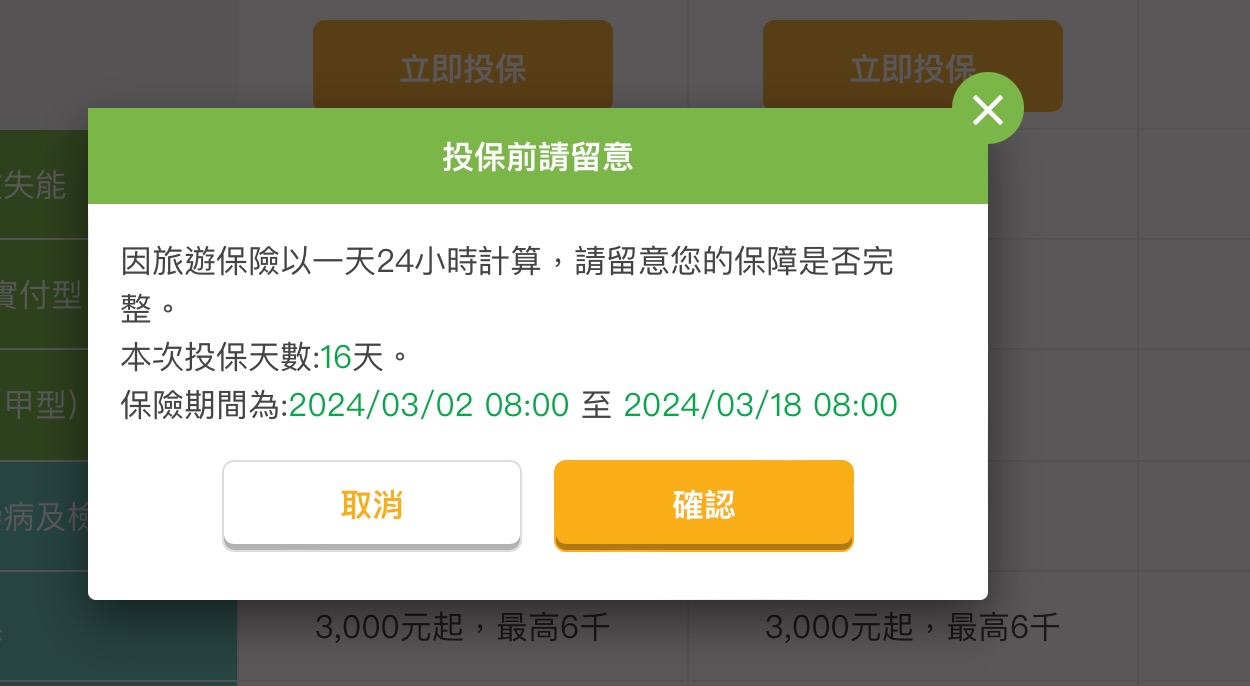

✅ 會以 24 小時來計算. 例如實際上我旅行天數是 15 天 , 早出晚歸. 礙於是以 24 小時計算, 我需要保 16 天

Fubon and Cathay both provide online insurance estimates. The Cathay estimation (Link) can also be done on a mobile device. The result of the estimation is the final amount, and there are no additional charges. You can pay the insurance fee with the credit card.

Points to note:

✅ The “travel period” is mainly the time when the journey begins, not the time the flight departs.

✅ It is calculated in 24-hour increments. For example, if the actual duration of my trip is 15 days with early departures and late returns, due to the calculation in 24-hour increments, I need to insure for 16 days.

Link: https://www.cathay-ins.com.tw/INSEBWeb/BOBE/travel/travel_quote/prompt

選擇的國泰海外平安險 (T2) 已足夠

Cathay Travel Insurance (T2 type ) coverage is enough

很多人用信用卡買機票都會有免費的旅遊平安險, 保額通常都比較低. 直接線上投保有多項選擇, 而且保額都會比較高. 我保險其實是為了家人比較能夠有更多理賠金額處理意外產生的費用

Many people who purchase tickets with a credit card often have free travel insurance, but the coverage amount is usually relatively low. There are multiple options for direct online insurance purchase, and the coverage amounts are generally higher . In reality, I purchased insurance more for the sake of my family, ensuring that there would be a higher amount available for handling unexpected expenses resulting from accidents.

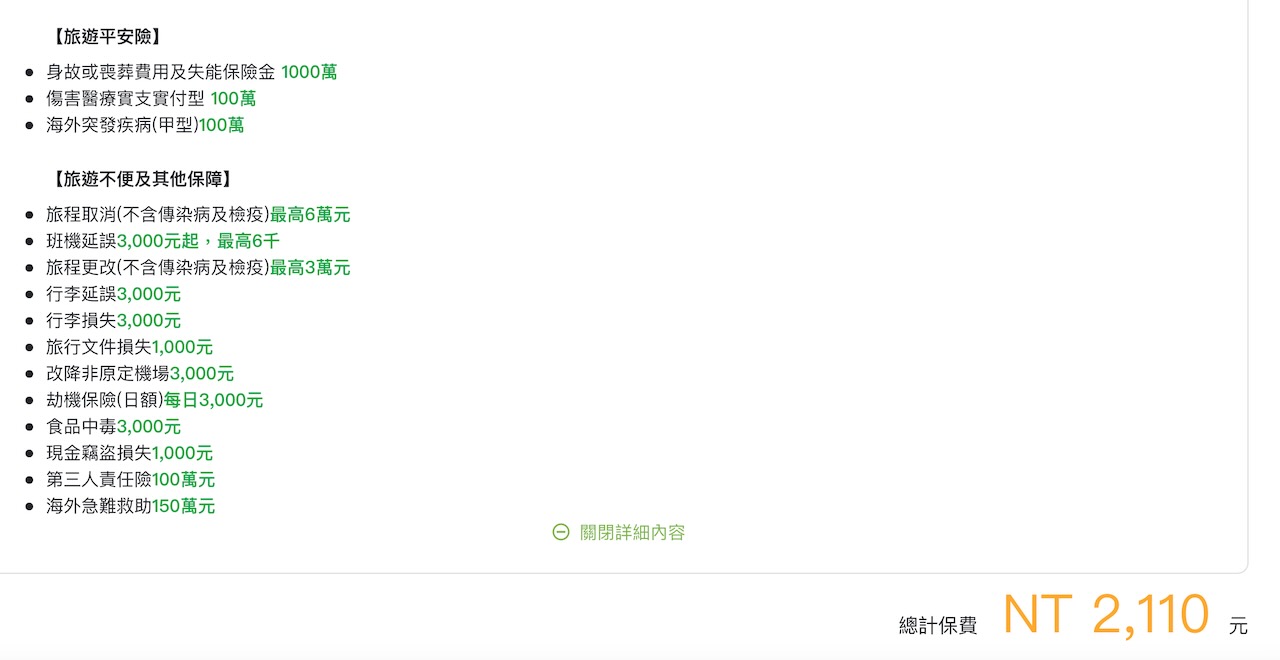

國泰海外平安險 (T2 )

About Cathay Travel Insurance (T2 type )

✅ 試算 16 天的保險結果, 國泰海外安心型 (T2) (NTD $2110) vs 早鳥豪華型(NTD $2425) . 居家竊盜損失與信用卡盜用損失項目比較用不到. 原因是居住大樓有管理員, 不太可能被偷. 我個人有信用卡公司的 App , 有盜刷基本上第一時間會有訊息, 台灣處理盜刷的速度也很快 .我們旅行都會帶WiFi分享器 , 在各國可以收訊息

✅ 網路提到郵輪的通訊只能靠衛星通訊, 也沒有 wifi. 如果旅客在海上發生意外, 通知救援通常是衛星通訊 + 直升機, 金額費用很高. 早鳥豪華型裡的海外急難救助是 300 萬元, 海外安心型 (T2) 的海外急難救助是 150 萬, 感覺150 萬已足夠.

✅ After calculating the insurance for 16 days, the results for Cathay Insurance (T2) (NTD $2,110) vs. Early Bird Deluxe (U2) (NTD $2,425) were compared. The items related to home theft loss and credit card misuse were considered unnecessary. I have the credit card company’s app, and in the case of unauthorized use, I typically receive a notification promptly. The handling speed for credit card misuse in Taiwan is also fast. Additionally, we usually carry a WiFi router when traveling, ensuring that we can receive messages in various countries.

✅ It’s mentioned online that communication on cruises relies on satellite communication and there is no WiFi. In the event of an accident at sea, notifying rescuers typically involves satellite communication and helicopters, incurring high costs. The overseas emergency assistance in the Early Bird Deluxe plan (U2) is NTD $ 3 million, while the (T2) plan offers NTD $1.5 million for overseas emergency assistance. It seems that NTD $1.5 million should be sufficient.

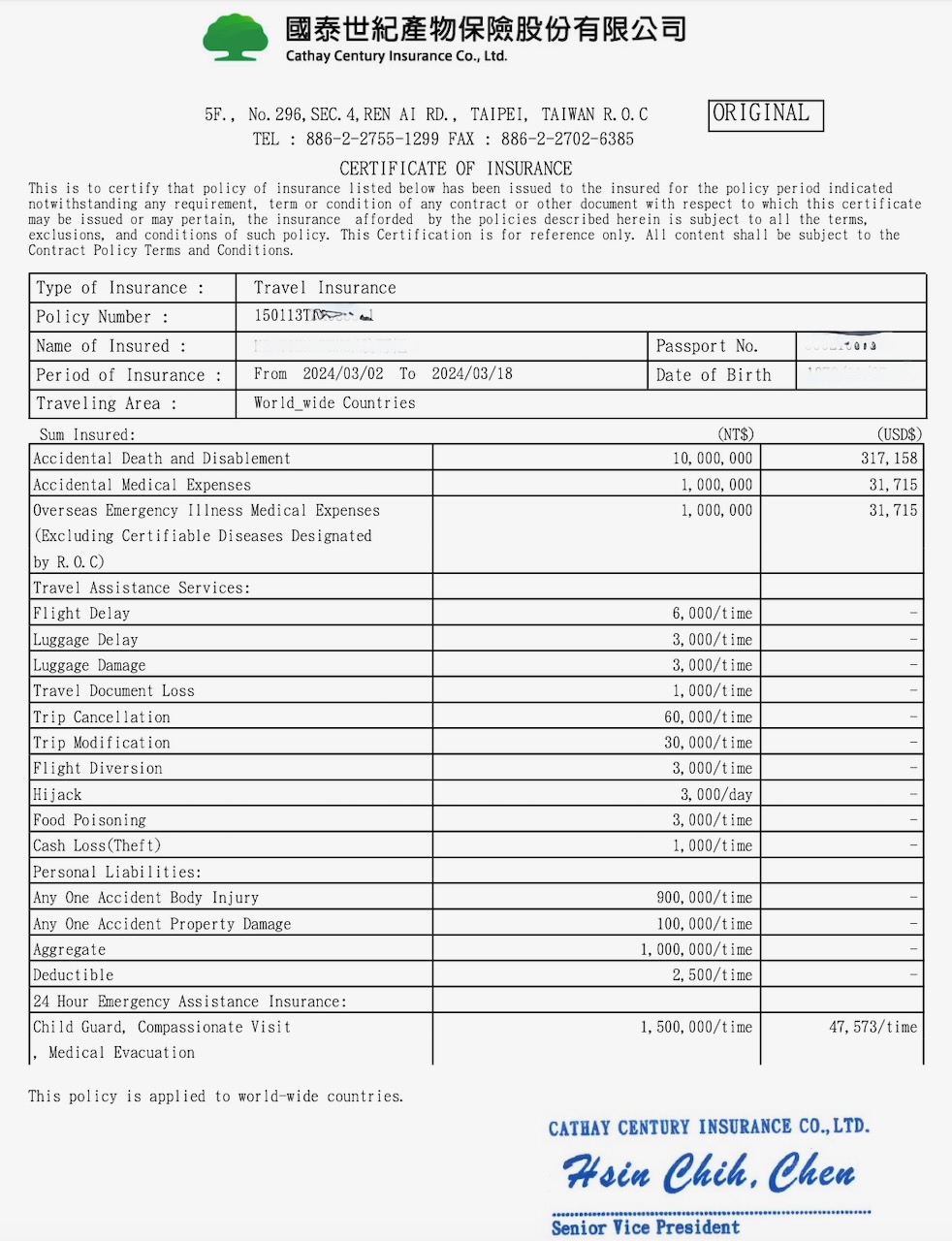

有英文保單

English version Insurance Slip

國外旅遊有英文保單會比較心安. 注意事項則是英文保單需要填寫護照號碼. 英文保單的範例也將台幣與美金放在同一張保單上 (圖一) , 建議截圖放在手機裡, 旅行更為方便.

Having the english version insurance slipprovides a sense of security. However, it’s important to note that for an English policy, you will need to provide your passport number. The English version certificate has both NTD and USD dollar on the paper. I would suggest to save this in your cellphone.

保單細節都在網站後台

Insurance Slip details are at website after log in

投保的同時已經包括註冊國泰產險的網站. 保單資料都會在後台, 搜尋方便.

At the time of purchasing insurance, the registration with Cathay Century Insurance’s website is included. Policy details will be available in the backend, making it convenient for searches.